We Asked

- Rate your satisfaction with purchasing online

- Specifically, by Tools, Outdoor Plants, Indoor Plants, Trees & Shrubs, Soil & Fertilizers, Hard Goods, Seeds

They Answered

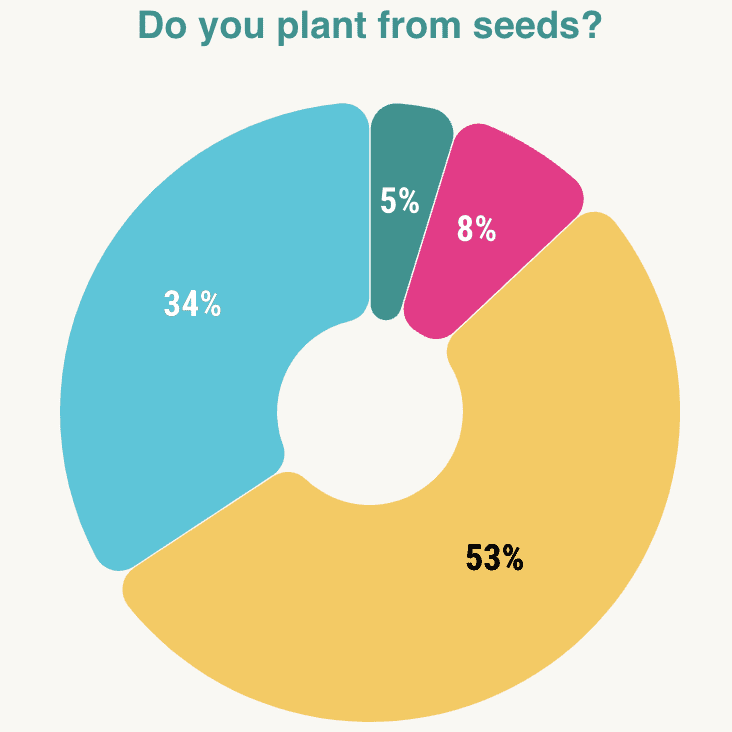

Analyzing the survey results regarding satisfaction with purchasing gardening products online, it’s evident that the preferences and experiences of gardeners vary significantly across different product categories. Seeds stand out as the category with the highest level of satisfaction, with 37% of respondents rating their experience as ‘Excellent’ and a further 28.60% as ‘Good’. This indicates a strong positive reception for purchasing seeds online, likely due to the ease of access, variety, and possibly the quality of information available.

Conversely, indoor plants have the lowest ‘Excellent’ rating at only 4.41%, and a notable 36.04% of respondents have not tried and will not try purchasing indoor plants online, the highest percentage across all categories for this option. This reluctance could stem from concerns over the delicate nature of these plants during shipping, or the preference for in-person selection. The ‘Haven’t tried, but will’ responses are significant across all categories, especially for indoor plants (29.19%) and soil & fertilizers (26%), suggesting a curiosity or openness among gardeners to explore online purchasing options in the future. However, there’s a visible hesitancy towards buying indoor plants and hard goods online, as reflected in the higher percentages of respondents who have not tried and will not try these categories. Overall, while seeds enjoy robust confidence among online shoppers, other categories like indoor plants and hard goods face skepticism, indicating a need for improved trust and satisfaction in these areas.

Rate your satisfaction with purchasing online

Interpreting mixed signals is not easy when planning for 2024

- Check back for updates to this particular Insight in Jan/Feb, sentiments will have likely changed

- Be clear about the reasons for having increased your prices

- Consumer balance sheets are still reasonably strong, but the trend is down – consider a strategy to sell to capacity as early as possible in 2023, before consumers are running out of cash and are forced to turn to credit.

By Demographics

The rest of this insight is for members only, please Sign In or Sign Up to continue.

Join Now

Google Trends for Buying Garden Items Online

The trends on Google for the last five years clearly shows that interest in buying seeds online by far surpasses searches for buying other garden items. This is as exepcted, as gardeners have indicated a far higher level of satisfaction buying seeds online than any other garden item. Also, the trend to search for buying seeds online has persisted after “the COVID bump”, whereas interest in buying other garden items online is virtually non-existent after the COVID bump. Note that this doesn’t mean the interest is Zero – people are clearly buying for instance Houseplants online – Google doesn’t count low search volumes, making it appear as if the interest is zero.

Expert Opinion

LaManda Joy - Simple Spring / Great Grow Along

Sue Goetz - Owner & Lead Designer of Creative Gardens

Join Now